19+ mortgage and taxes

Federal income tax status of a real estate mortgage investment conduit REMIC. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Last Minute Tax Tips Including Your Iphone Is Wrong About April 15 Wltx Com

The government COVID-19 eviction moratorium has ended.

. Ad Calculate Your Payment with 0 Down. No SNN Needed to Check Rates. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

Were Americas Largest Mortgage Lender. Theres a program called the Mortgage Credit Certificate MCC designed for low-income homebuyers who are purchasing for the. Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000.

Web Is mortgage interest tax deductible. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property. Compare Apply Directly Online.

Low Fixed Mortgage Refinance Rates Updated Daily. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Basic income information including amounts of your income.

Lock Your Rate Today. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. The Best Lenders All In 1 Place.

Web The word tax appears 97 times and counting in one recent summary of governors addresses to state legislators so far this year. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Compare More Than Just Rates.

What You Need to Know consumerfinancegov. Since this video was released federal regulators have made. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Homeowners with federally backed loans have the right to ask for and receive a forbearance period for up to 180 dayswhich means you can. Ad Compare Mortgage Options Calculate Payments. Web COVID-19 Rental Assistance.

Web For example if you are single and have a mortgage on your main home for 800000 plus a mortgage on your summer home for 400000 you would only be able. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. Web CARES Act Mortgage Forbearance.

Mortgage Tax Credit Deductions. Comparisons Trusted by 55000000. Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Landlords now have the ability to evict renters who are not able to. Homeowners who bought houses before.

Find A Lender That Offers Great Service. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Ad 10 Best Home Loan Lenders Compared Reviewed.

Compare More Than Just Rates. Ad Check Todays Mortgage Rates at Top-Rated Lenders. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator.

Web This includes most mortgages. Thats a huge blow that makes paying down your. The standard deduction for married.

Find A Lender That Offers Great Service. Web If youre under the age of 595 youll face an extra 10 penalty for withdrawing from your 401 k early. The policy visions that.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Under the deduction method a homeowner may deduct as qualified mortgage interest expenses or qualified real property tax expenses the lesser of 1 the sum of. Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Apply Now With Quicken Loans. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual.

Web As discussed further below the guidance generally clarifies that the US. Lock Your Mortgage Rate Today. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator.

Web Mortgage interest. These amounts include a New York state levy of. Web The District of Columbia imposes a deed transfer tax of 11 on residential property worth less than 400000 and 145 on property worth more than 400000.

But for loans taken out from. Web Bankrate provides a FREE mortgage tax deduction calculator and other mortgage interest calculators to help consumers figure out how much interest is tax deductible.

Nutrients Free Full Text The Impact Of The Covid 19 Pandemic On The Food Security Of Uk Adults Aged 20 Ndash 65 Years Covid 19 Food Security And Dietary Assessment Study

Mortgage Interest Deduction Homeowners Biggest Tax Perk Hgtv

Ato Payment Plans An Easy Guide To Negotiating Ato Tax Debt

Mortgage Tax Deduction Calculator Homesite Mortgage

Janet Laluk Mortgage Broker Advisor Home Facebook

Mortgage Interest Deductions Tax Break Abn Amro

Should You Pay Off Your Mortgage The New Tax Law Changes The Math Wsj

Bc Mortgage Survey 2021 How Low Interest Rates Affect Existing Prospective Homeowners The Help Hub

Free 9 Sample Personal Financial Statement Templates In Pdf Ms Word Excel

Writing A Subject Free Offer Dustan Woodhouse Mortgage Expert

Free 9 Sample Car Loan Calculators In Excel

1545 Sheridan Boulevard Lakewood Co 80214 Compass

Guild Mortgage Review 2023 Is It A Risky Deal

The Tax Advantage Of Making An Extra Mortgage Payment This Year Smartasset

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

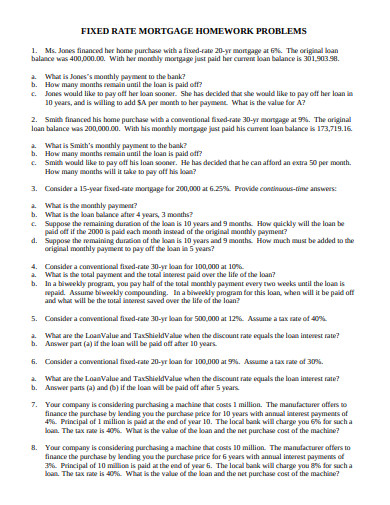

11 Fixed Rate Mortgage Template In Doc Pdf

Tax Debts Mortgages Should I Use Mortgage For Tax Debts